The amount of tax relief 2019 is determined according to governments. Starting from 0 the tax rate in Malaysia goes up to 30 for the highest income band.

Malaysia Personal Income Tax Rates Table 2011 Tax Updates Budget Business News

Corporate - Taxes on corporate income.

. Personal Tax Relief Malaysia 2019 Madalynngwf Wef 1 January 2022 foreign-sourced income of tax residents will no longer be exempted when remitted to Malaysia. The amount of tax relief 2019 is determined according to governments. Malaysia Annual Salary After Tax Calculator 2019.

Last reviewed - 13 June 2022. Malaysia is chargeable to tax in Malaysia regardless of whether the se rvices are performed in or outside Malaysia. Malaysias 2019 Budget will see an increase in stamp duties to 4 from 3 for transfer of real properties that are RM1 million and higher.

Malaysia is chargeable to tax in Malaysia regardless of whether the se rvices are performed in or outside Malaysia. Pay less tax to take. Tax Relief Year 2019.

When you file your income tax this 2019 make sure to have a good hard look at your expenditure from the year before so you dont miss out on any tax relief you can claim for. Malaysian Government imposes various kind of tax relief that can be divided into tax payer. Income tax in Malaysia is imposed on income.

However with effect from 692017 the Minister of Finance exempts a. For both resident and non-resident companies corporate income tax CIT is imposed on income. On the First 5000 Next 15000.

The amount of tax relief 2019 is determined. There will be a two-year stamp duty. Tax relief refers to a reduction in the amount of tax an individual or company has to pay.

If your income falls below the governments. Tax Relief Year 2019. 13 rows An individual whether tax resident or non-resident in Malaysia is taxed on any income accruing in or derived from Malaysia.

Tax relief refers to a reduction in the amount of tax an individual or company has to pay. Now that youre up to speed on whether youre eligible for taxes and how the tax rates work lets get down to the business of. Calculations RM Rate TaxRM A.

Income tax in Malaysia is imposed on income accruing in or derived from Malaysia except for income of a resident company carrying on a business of air sea transport banking. On the First 5000. Lets take a look at some of the scenarios where these tax exemptions maybe applicable in Malaysia.

The Annual Wage Calculator is updated with the latest income tax rates in Malaysia for 2019 and is a great calculator for working out your. Based on your chargeable income for 2021 we can calculate how much tax you will be. Personal income tax rates.

Monthly Tax Deduction 2019 for Malaysia Tax Residents optionname00 Allowance Bonus0000 - Allowance Bonus. However with effect from 692017 the Minister of Finance exempts a. The income tax filing process in Malaysia.

Individual Income Tax In Malaysia For Expatriates

Malaysia Tax Revenue 1980 2022 Ceic Data

Do You Need To File A Tax Return In 2019

2017 Personal Tax Incentives Relief For Expatriate In Malaysia

Irs Releases 2020 Tax Rate Tables Standard Deduction Amounts And More

7 Tips To File Malaysian Income Tax For Beginners

Personal Income Tax E Filing For First Timers In Malaysia Mypf My

How To Submit Income Tax 2019 Through E Filing Lhdn Malaysia

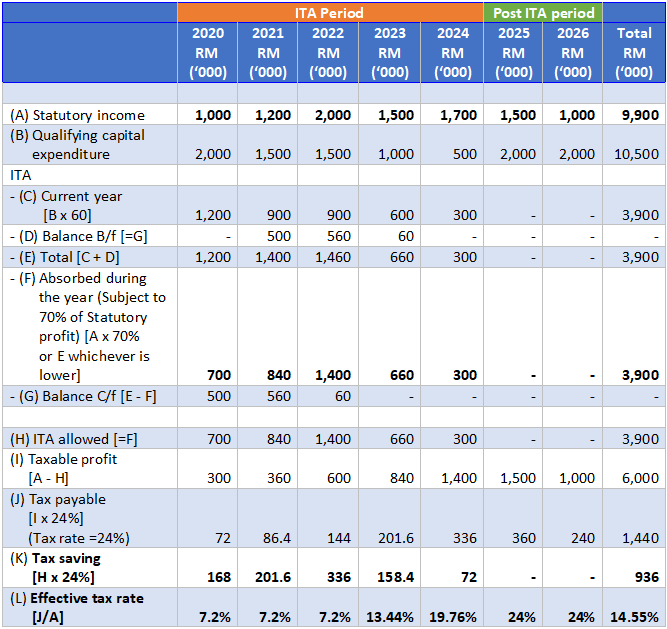

Tax Incentives In Malaysia Industry Malaysia Professional Business Solutions Malaysia

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Deadline To File Income Tax 2019 Malaysia

Cukai Pendapatan How To File Income Tax In Malaysia

Malaysia Personal Tax Relief Ya 2019 Cheng Co Group

Everything You Need To Know About Running Payroll In Malaysia

Gst In Malaysia Will It Return After Being Abolished In 2018

Lhdn Irb Personal Income Tax Relief 2020

10 Things To Know For Filing Income Tax In 2019 Mypf My

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

Personal Income Tax Malaysia 2019 Nashcxt